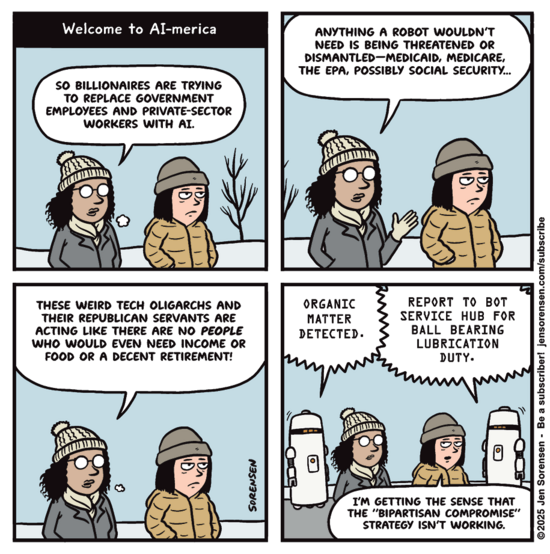

Tally up Donald Trump’s speeches, press conferences, and executive orders since returning to office in January and you’ll find the president keeps coming back to the same topic—and it isn’t immigration, Ukraine, or even his polls. Trump has spent more time this year talking about artificial intelligence than almost any other issue, much to the delight of Silicon Valley’s billionaire class.

In one of his first official acts, Trump steered $100 billion into the pockets of mega-rich AI entrepreneurs like OpenAI’s Sam Altman. Two days later, Trump doubled down with an executive order calling for a government-wide “AI Action Plan” that would distribute billions more dollars to his tech bro backers. In all, Trump has pledged over $600 billion in private sector and taxpayer money to fund AI development.

Trump finally unveiled his plan in July, which includes 90 policy actions designed to ease regulation on AI while showering executives like Altman, X CEO Elon Musk and Meta CEO Mark Zuckerberg with billions in federal dollars. There’s just one problem: A new report from MIT found that over 95% of AI companies fail without providing a dime of return to investors or the public. That report drove a massive AI stock sell-off this week, and tech guru Erik Gordon predicts investors’ financial pain is just beginning.

You may not know it yet, but that means you.

Related | Trump never hated Big Tech. He just wanted them on board.

If you invest in an employer 401(k) or participate in a public employee pension program like California’s CalPERS, you’re invested in many of the AI companies bleeding value this week. And the numbers aren’t small: Half of CalPERS’ top 10 holdings are AI companies, amounting to roughly $30 billion of the fund’s $587 billion in assets. Most of CalPERS’ 2 million customers don’t even know their retirements are inextricably linked to the AI bubble.

Those AI stocks surged over the summer thanks to Trump’s promises of easy money feeding a stock market hype cycle. But that summer fling has transformed into a nasty autumn hangover. The budding AI industry is currently in the midst of its largest-ever slide in market value at the same time as CEOs are rewarding themselves with lavish pay increases. Nvidia’s Jensen Huang gave himself a 49% pay bump back in May. Meta, whose AI is programmed to flirt with children, gave its executives eye-watering 200% bonuses while laying off rank-and-file workers.

As economic experts begin to call the top of the AI bubble, executives are extracting cash from their companies faster than ever. And why should they care? A growing percentage of that cash now comes courtesy of the American taxpayer—whether taxpayers want them to have that money or not. Now companies like Nvidia are threatening that AI development will go on “without the U.S.” unless Trump keeps the money flowing. To most people, that would sound like a threat. Trump sees it as an opportunity to make a little money via some lucrative side deals.

As Daily Kos reported in May, Trump’s interest in AI has less to do with his understanding of the technology and more to do with bringing Silicon Valley’s richest players into his sphere of influence. The tech CEOs—many of whom detest Trump’s personality and politics—are equally willing to make terms with him for the promise of looser regulations and an ever-flowing faucet of federal money. Last month Trump announced another $95 billion in AI data center investment in Pennsylvania, just days after Zuckerberg stressed the importance of building Manhattan-sized data centers across the nation to fuel AI’s ever-expanding demand for resources. Unsurprisingly, pro-Trump management firm Blackstone is expected to be a major player in building Pennsylvania’s new data megacenters.

Pennsylvania is just the latest stop in the Trump administration’s push to scale AI development without concern for its environmental impacts. In June, Environmental Protection Agency Administrator Lee Zeldin encouraged coal plants to tell him which regulations they hated the most, with the goal of making coal the official energy source of the AI revolution. The White House is so hungry to deliver dirty power to AI data centers that they’ve even allowed uranium mines to bypass environmental checks in order to squeeze more power from the nation’s 93 commercial nuclear reactors.

All that White House help doesn’t seem to be stabilizing what has always been a wildly speculative and unproven AI market. As even established, well-connected AI firms like Palantir see their share prices plunge by over 20%, many veteran tech investors are warning that smaller AI firms could trigger a cascade of tech bankruptcies. Only Trump’s personal AI picks seem to be immune to market corrections.

Without a direct line to the White House, regular Americans are left holding the bag as AI stocks tank in value, causing their retirement funds to contract at a rate usually only seen during recessions. Trump may have hundreds of billions of dollars to throw at the world’s wealthiest tech CEOs, but he doesn’t have a dime for the Americans whose pensions are being gutted by politically protected AI hucksters.

So far, Trump hasn’t even acknowledged the pain hitting millions of investors including those nearing retirement. He should ask AI to write an apology to the American people. They’ve certainly paid for it.